Undergrad Capstone Project: Emerald

Created in partnership with Scotiabank FactoryU

Task:

As young people are becoming priced out of the housing and investment market, how might the bank provide new digital solutions for young Canadians to thrive in today’s challenging economy?

My Role:

- Key participant in ideation and brainstorming sessions

- Spoke with stakeholder (Scotiabank FactoryU) to validate research and potential solutions

- Met with potential users and lead five usability testing sessions

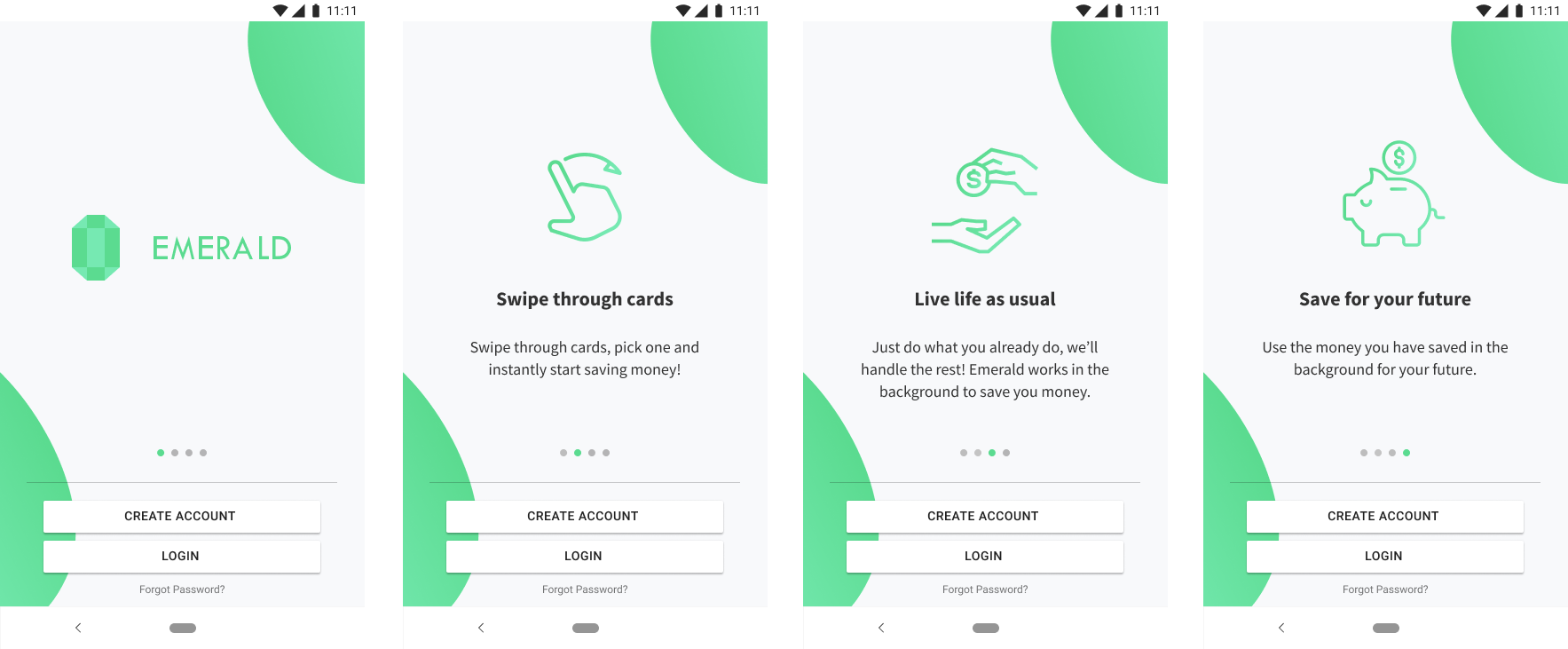

- Responsible for designing the app’s onboarding screens as well as some of the card screens

- Designed numerous iterations of mockups, wireframes and parts of the final prototype.

Click here to view the live app prototype (best viewed on a mobile device) or continue scrolling to see my process.

Understanding The Problem

Initial problem statement:

Due to a lack of trust in an overwhelming amount of available financial information, young Canadians are unsure of how to spend their money efficiently when they are ready to invest and/or purchase real estate.

How do we know there is a problem:

- Canadians have an abundance of resources for financial info (mutual fund companies, robo-advisors, digital banks, financial advisors, family/friends etc).

- 43% of Canadians said they are the most capable of helping themselves invest or manage their money most effectively (people trust themselves the most).

- Many young Canadians are prevented from investing in real estate because they think that they are too young or that don’t have enough funds.

Goal:

To provide a digital solution that helps young Canadians save money while ultimately allowing them to thrive in today’s challenging economy.

Defining The Problem

Problem Statement Pivot: Many young Canadians (20-34) aren’t motivated to change their financial actions to positively affect their future self pertaining to savings, retirement and investing.

Initial findings:

- According to a new CIBC poll, 32 % of Canadians between 45 and 64 have nothing saved for retirement

- Those with an annual income under $50,000 are most likely to have savings under $1,000

- Canadians earning less than $40,000 annually are most likely to cite “lack of income” (65%) as an obstacle in managing their money and investing, ahead of those earning $40,000 – $60,000 and those earning $60,000 – $100,000. 26% of Canadians earning more than $100,000 cite “lack of income” as an obstacle.

Initial solution:

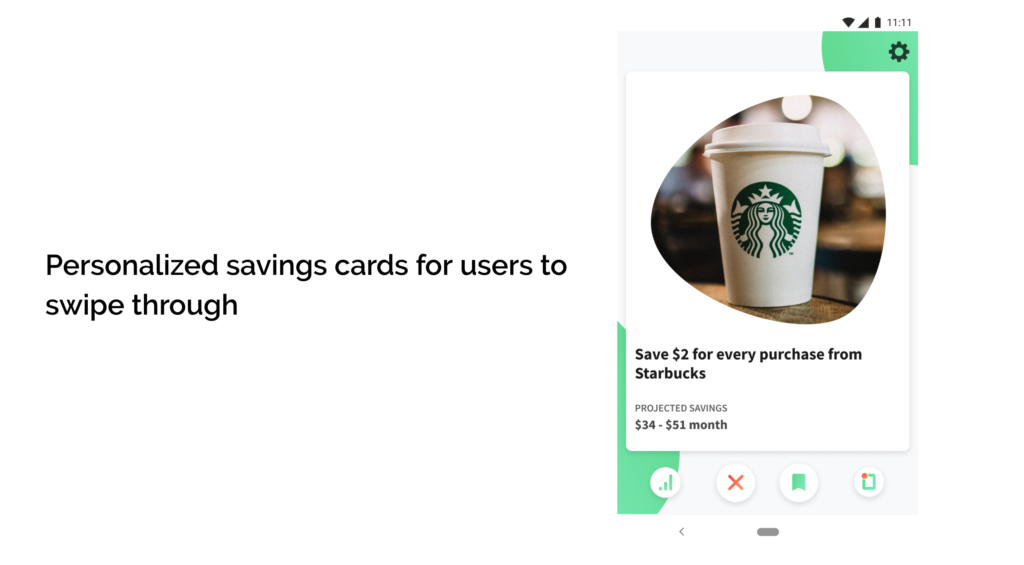

A card swiping based app (similar to tinder) that presents users with different methods of saving/investing/gathering financial information.

- Users complete various challenges (for example: Open a TFSA or put $100 in your savings account) to gain points

- Points can be used for social good or to redeem various prizes

Problems:

- Trying to incorporate too many elements, making the solution difficult to execute.

- Although a point system is nice, it is not enough incentive for users to change their habits

User Personas

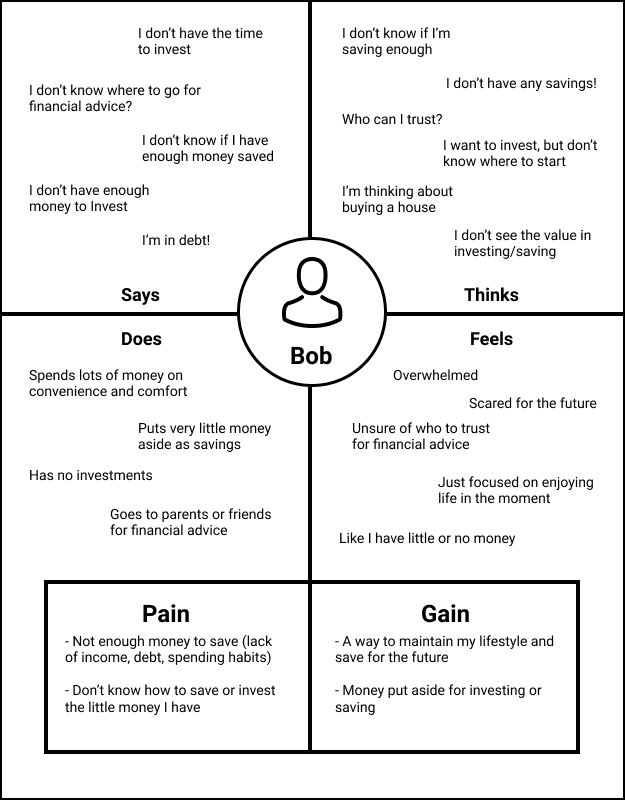

I created an empathy map as a precursor to the user personas as a way to better understand our target market and prioritize our user’s needs. The target market is very large (young Canadians aged 20 – 34) so there are a number of potential users in this market. This being the case, I decided to create a general empathy map to cover the entire market.

By creating this empathy map, I made it easier for my team to categorize the research we had collected, and to discover areas where we needed to do more research. Ultimately it streamlined the process of finding two distinct user personas that fit within our target market.

The first persona is a 23-year-old male who just graduated from University. Research shows that millennials spend $4 or more on a coffee, tend to use Uber and Taxis more when compared to Generation X and Baby Boomers. This group also goes to live events with their friends more than other generations due to the phenomenon known as FOMO (Fear of Missing Out). They value comfort and convenience and believe experiences are important than materialistic things. However, due to their expensive spending, they don’t have enough money to save up nor keep up with their lifestyle. The average Canadian student has 22 thousand dollars debt, and 19% of Canadians have less than $1000 in their savings. Michael wants to maintain his current lifestyle but also save money for his future.

The second persona is another young Canadian who has minimal savings. Their wish is to move into a home that they own. Research shows, housing prices in Canada compared to average income has risen from 4:1 to 10:1 since the 1970s. This means these individuals will need to work longer hours or find another source of income. At the rate that they are currently saving, they won’t have enough money to purchase a house any time soon. They wish they could invest to earn more income, but lack the knowledge when it comes to saving/investing.

User Journey Map

For the User Journey Map, we chose Michael to be our user. The Journey Map consists of 5 stages: Awareness, Registration, Choosing Targets, Accomplishing Targets, and Complete.

Decide and Prototyping

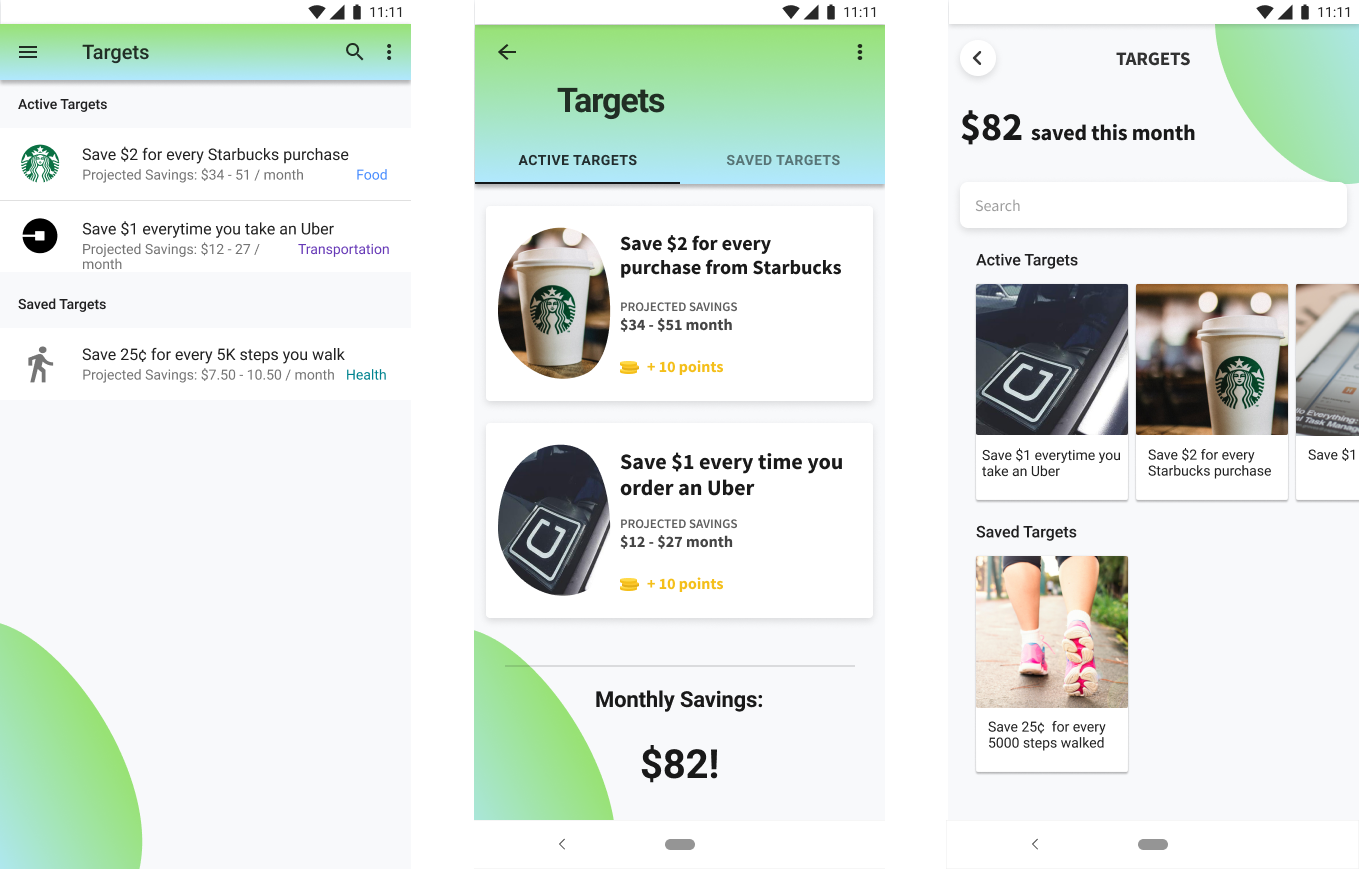

Some Initial Screens:

More Developed Iterations:

Usability Testing

I led the usability testing sessions at the University of Waterloo’s Student centre, with my team assisting. My team and I met with five potential users, asked them questions, and conducted usability testing on our prototype. At the beginning of the testing sessions, I asked users demographic questions such as;

- How old are you?

- Are you looking to save money?

- How are you currently saving? etc.

Next, I let users work through the prototype while asking them prompting questions like;

- What are your impressions of this screen?

- What would you expect or want to see if you click here?

- What would you improve or change? etc.

After users had worked through the entire prototype, I asked a few follow-up questions including but not limited to;

- What do you think is the core value our app provides?

- If you could develop your own challenge what would it be?

- How would you improve the app? etc.

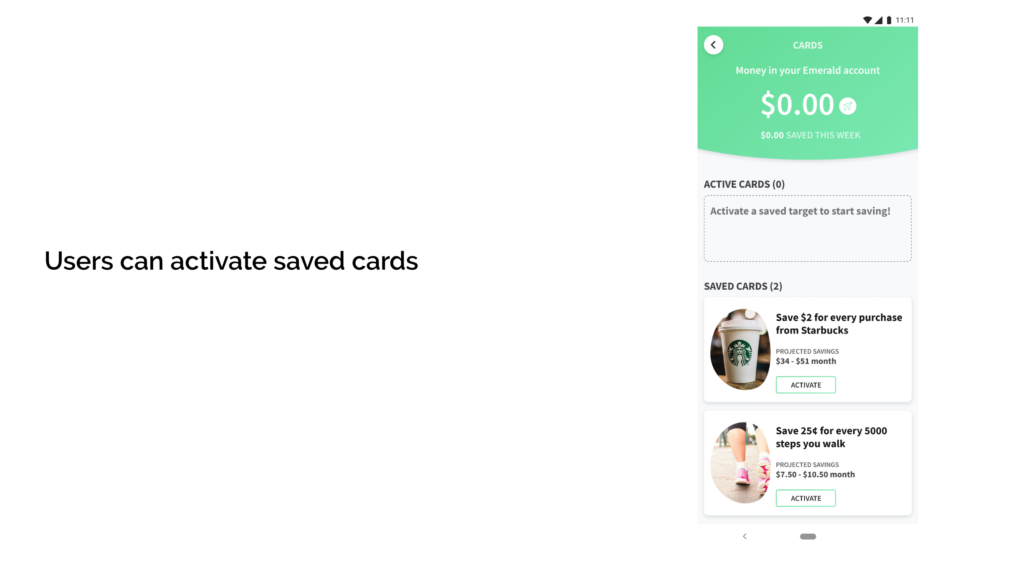

User Testing Results:

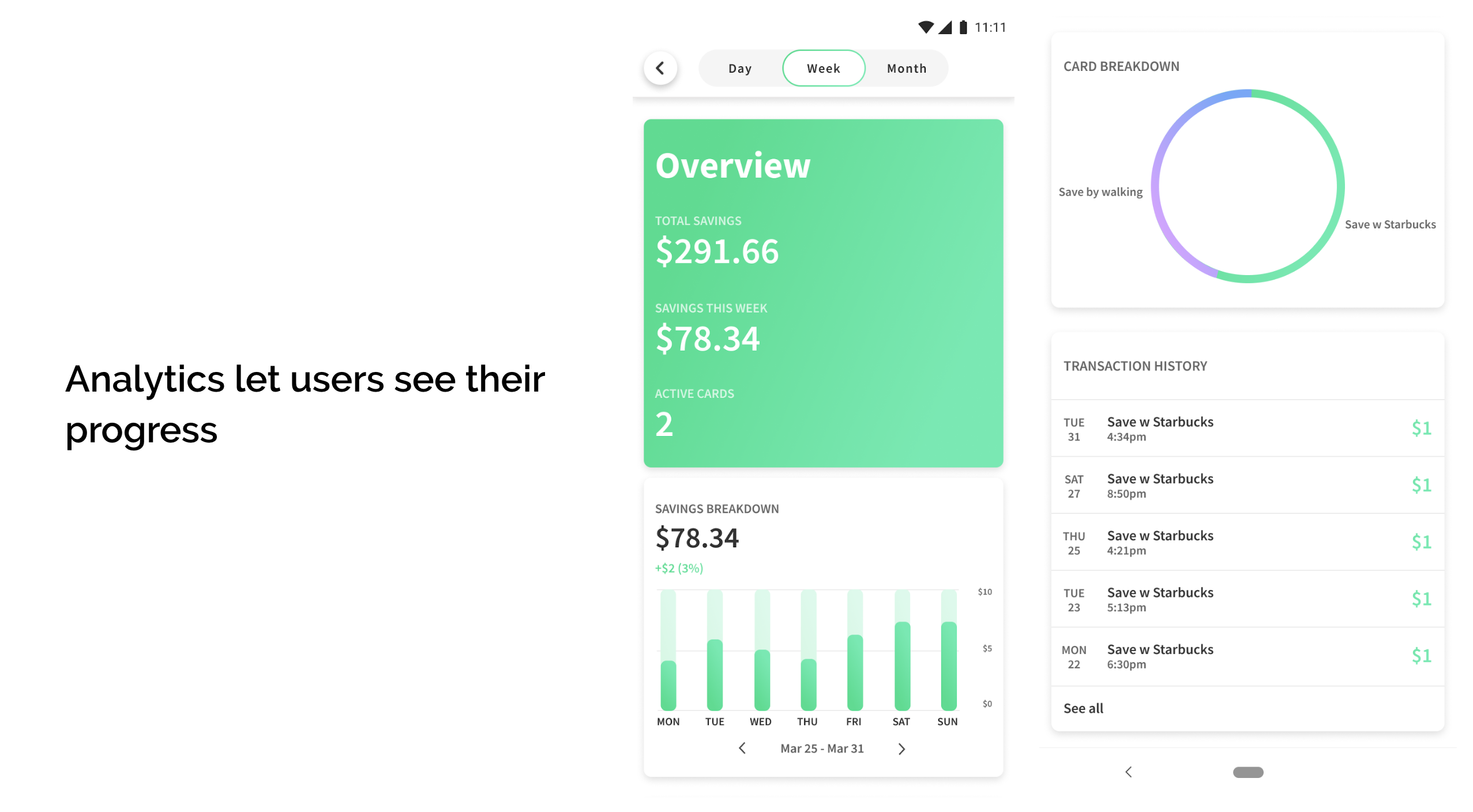

| Visual | Functional | Service |

| – users wanted to see a breakdown of their savings / some analytics | – Many users were confused by the icon that we choose for our cards, making it difficult for them to find their saved cards after they had swiped them. | – Confusion around the points system. In our initial prototype, each card had points associated with them. The majority of users found the points quite confusing so we decided to completely remove them in the final prototype. – users would like to see more cards/card customization (i.e. changing the $ value of a card) |

Results

Final Solution:

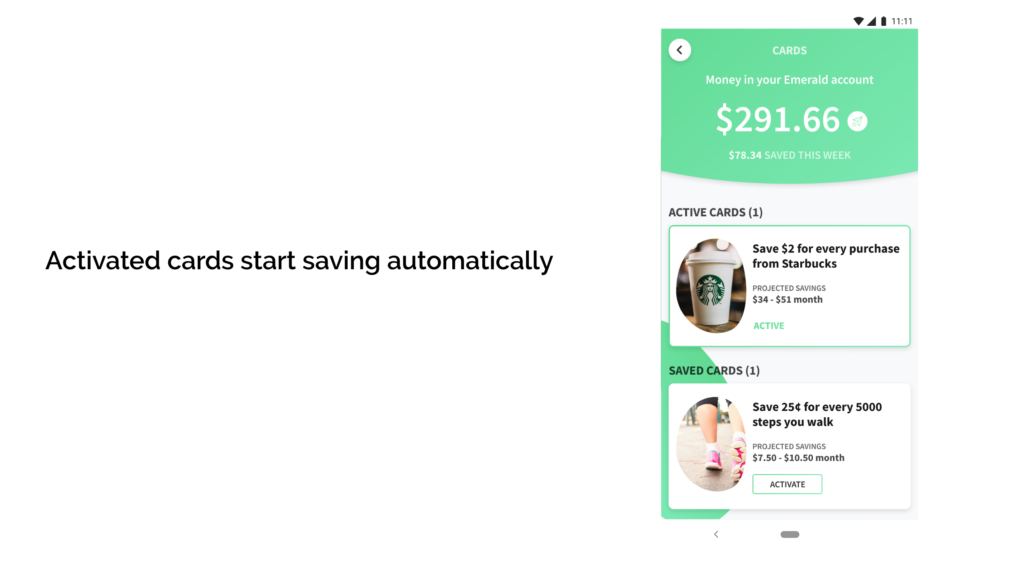

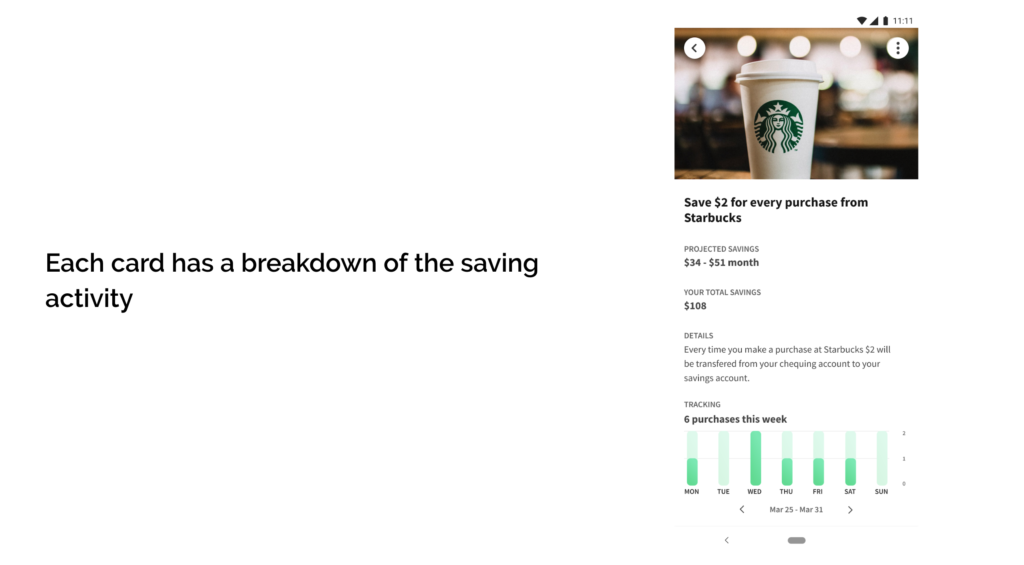

A swiping based app that allows users to subconsciously put some of their own money aside for saving, without having to make any changes to their everyday lives. The app provides users with personalized cards that have various day to day tasks which can be tracked through a smartphone or bank account. Each card has a dollar value associated with it and if a user completes the task on a card, that dollar value will be automatically transferred from their checkings account to their savings account within the app. For example, a card may say; save $2 for every Starbucks purchase or save $0.25 every time you walk 5000 steps. Cards will leverage everyday activities/purchases that our users already make on a daily basis so that they can begin to automatically gain some savings.

Click here to view the live app prototype (best viewed on a mobile device)